Leasing a tractor trailer might seem like a daunting process, but it can be broken down into a few simple steps to help you get started quickly and efficiently.

Leasing a tractor trailer can provide financial freedom and flexibility for your business, enabling growth without the hefty initial investment of buying outright. It can also offer predictable monthly expenses, letting you budget more effectively and focus on expanding your operations.

With the right approach, you can navigate the leasing process to secure a deal that aligns with your business goals, ensuring you have the reliable, high-quality equipment needed to succeed.

5 Simple Steps on Lease Agreements: How to Lease a Tractor Trailer?

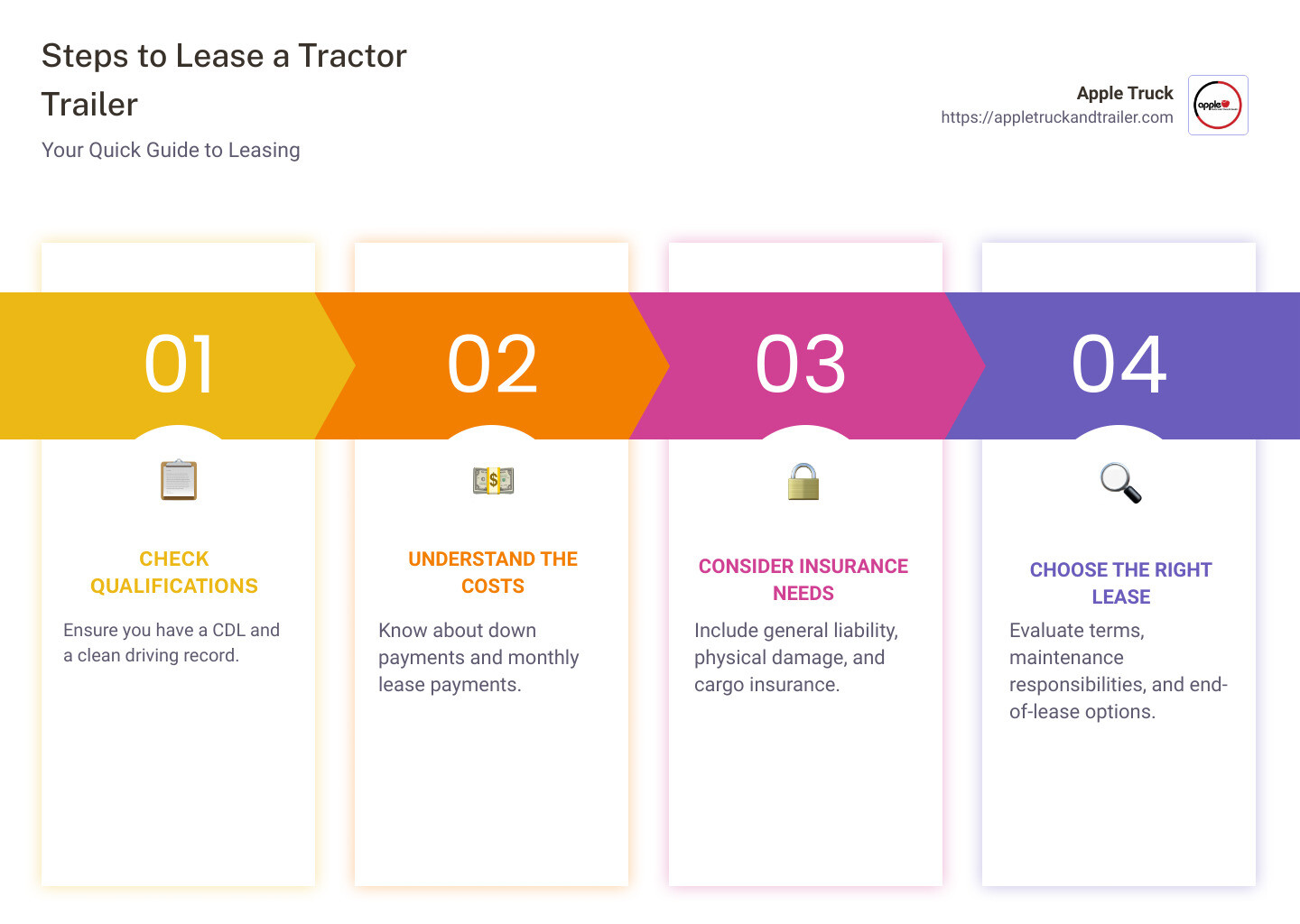

- Check Your Qualifications: Ensure you have a Commercial Driver’s License (CDL) and a clean driving record.

- Understand the Costs: Be aware of down payment requirements and monthly lease payments.

- Consider Insurance Needs: Factor in the cost of general liability, physical damage, cargo insurance, and any additional coverage.

- Draft a Business Plan: Even if not required, a solid plan helps in negotiations and future financial planning.

- Choose the Right Lease: Evaluate terms, maintenance responsibilities, and end-of-lease options to find the best fit for you.

Table of Contents

Understanding Tractor Trailer Leasing

When you’re looking into how to lease a tractor trailer, it’s crucial to grasp the basics. This understanding will help you make informed decisions that align with your business needs and financial situation. Let’s dive into the key areas you need to know about.

Lease vs. Buy

Leasing a tractor trailer often means lower upfront costs and the flexibility to upgrade to newer models more frequently. It’s a solid choice if you prefer predictable monthly expenses over truck ownership and want to avoid the depreciation costs associated with owning.

Buying, on the other hand, makes you the outright owner. It’s a long-term investment that could save you money over time, but it requires a significant initial financial commitment.

Eligibility Criteria

To lease a tractor trailer, you need to meet certain criteria:

- Commercial Driver’s License (CDL): This is non-negotiable. You must have a valid CDL to operate a tractor trailer, whether you’re leasing or buying.

- Credit Score: Your credit score plays a crucial role. While it doesn’t need to be perfect, a higher score can secure you better lease terms.

- Driving Record: A clean driving record is preferred. Companies look for drivers with minimal violations or accidents, as it indicates responsible driving behavior.

Credit Score

Your credit score is like a financial report card. It shows leasing companies how well you manage your finances. A higher score can lead to lower down payments and better interest rates. If your score isn’t where you want it to be, consider working to improve it before applying for a lease.

Driving Record

A driving record that’s free of major violations and at-fault accidents can make you a more attractive candidate to semi trucks and leasing companies. They want to lease their trucks to reliable drivers who are less likely to be involved in incidents that could damage the vehicle.

Understanding these aspects of tractor trailer leasing sets a solid foundation for your journey. It’s about matching your current situation and future goals with the right financial decision. Whether you choose to lease or buy, ensure it aligns with your long-term business strategy and personal preferences. Next, we’ll explore how to prepare for your lease, including financial preparedness and the importance of a comprehensive business plan.

Preparing for Your Lease

Before you dive into tractor trailer leasing, it’s crucial to get your ducks in a row. This preparation ensures you’re not just ready but also positioned for success. Let’s break down the essentials: Financial Preparedness, Down Payment Ranges, 0-Down Options, Comprehensive Business Plan, and Insurance Requirements.

Financial Preparedness

First things first, know your numbers. Understanding your financial standing is key. This includes knowing your current credit score, as it significantly affects your leasing terms. A higher credit score often means lower interest rates and better lease terms. But don’t worry if your score isn’t perfect; there are options for those with less-than-ideal credit scores too.

Down Payment Ranges

Down payments can vary widely based on the leasing company and your credit score. Generally, the better your credit score, the lower your down payment could be. Here’s a rough guide:

- 750+: You might be looking at down payments as low as 5%.

- 700-749: Expect something in the range of 10% to 20%.

- 650-699: Down payments could jump from 20% to 30%.

- Below 650: You might be required to put down 30% or more.

0-Down Options

For those with limited upfront cash, some leasing companies offer 0-down options. While this can make getting into a lease easier, it usually means higher monthly payments. It’s a trade-off worth considering based on your cash flow and financial strategy.

Comprehensive Business Plan

Having a solid business plan isn’t just for securing loans; it can also play a crucial role in negotiating favorable lease terms. Your business plan should detail the type of freight you plan to haul, expected revenue and costs, and your overall business strategy. This shows leasing companies that you’re serious and have thought through your business model.

Insurance Requirements

Insurance is a significant part of your monthly expenses when leasing a tractor trailer. You’ll need several types:

- General Liability: Covers vehicle and injury damages. Costs can range from $5,000 to $12,000 annually.

- Physical Damage: Protects against damages to your leased truck, with annual costs between $1,000 to $3,000.

- Cargo Insurance: Covers freight damages, costing roughly $400 to $1,200 annually.

- Bobtail/Non-Trucking Liability: For off-duty incidents, expect to pay $360 to $480.

- Gap Insurance: Covers the value of a totaled truck, with annual costs of $600 to $2,400.

By taking these steps, you’re not just preparing to lease a tractor trailer; you’re setting the foundation for a successful business. Next, we’ll explore how to choose the right lease option for your needs, including considerations like lease length, monthly payments, health insurance amount and maintenance responsibilities.

Choosing the Right Lease Option

When it comes to how to lease a tractor trailer, selecting the right lease option is crucial. It’s like picking a partner for a long journey. You want someone reliable, understanding, and flexible. Here’s how to make that choice:

Lease Length

Think about how long you want to be committed. Lease terms for commercial vehicles can vary significantly, from a short period of a few months to several years. Shorter leases offer more flexibility, while longer leases might come with lower monthly payments. Consider your business goals and how quickly they might change when deciding on the lease length.

Monthly Payments

Your budget will largely dictate this. Higher monthly payments can shorten the lease term but remember, as a lease driver, you’re also covering fuel, your insurance premiums, and maintenance. Opt for a payment that allows financial breathing room for the unexpected.

Maintenance Responsibilities

Who fixes what and when? Some leases include full maintenance packages, meaning less worry for you about upkeep costs. Others might require you to handle or contribute to maintenance and repairs. A clear understanding of these terms can prevent surprises down the road.

End-of-Lease Terms

What happens when the lease ends? Options might include returning the tractor trailer, buying it for a predetermined price, or extending the lease. Think about your long-term plan. If you aim to own, a lease-to-own option might be the best route.

Lease to Own Options

Speaking of lease to own, it’s a path worth considering if ownership is your ultimate goal. This option allows you to build equity in the tractor trailer over the lease term, leading to ownership at the end of contractual agreement. However, ensure you understand the financial implications, including total cost compared to outright purchasing.

Choosing the right lease option for a tractor trailer involves balancing your current financial situation, business goals, and the flexibility you need for future growth. Take the time to assess each factor carefully to make a decision that aligns with your long-term business strategy. The right lease can be a powerful tool for building your business success.

In the next section, we’ll dive into navigating the leasing process, including the application process, essential documentation, negotiating terms, and understanding the fine print. This step is where you solidify your commitment and ensure you’re getting the best deal possible.

Navigating the Leasing Process

Leasing a tractor trailer is a big step towards independence in the trucking industry. But, it’s not just about picking a truck and signing papers. There’s a process to ensure you’re making a wise choice. Let’s break it down into simple steps:

Application Process

First things first, you’ll need to fill out an application with the leasing company. This is where you share details about your business, driving history, and financial situation. It’s like introducing yourself on paper, so be thorough and honest.

Documentation

Next up, gather your documents. This usually includes your driver’s license, proof of insurance, and financial records. Think of it as packing a suitcase for a long trip. You want to make sure you have everything you need, so there are no delays.

Negotiating Terms

Now, for some, this part might seem tricky, but it’s just a conversation. You’re discussing the lease length, monthly payments, and what happens if you go over mileage limits. It’s okay to ask questions. After all, you wouldn’t buy a house without asking about the rooms and the neighborhood, right?

Reading the Fine Print

This part is crucial. The fine print is where all the details live. It talks about mileage restrictions, wear and tear fees, and maintenance responsibilities. Think of it as reading the rules before playing a game. You want to know what you can and can’t do.

- Mileage Restrictions: Most leases have a cap on how many miles you can drive. It’s like having a monthly allowance. Go over, and you might have to pay extra.

- Wear and Tear Fees: Just like renting an apartment, you’re expected to return the truck in good condition. Normal use is okay, but damages beyond that could cost you.

Conclusion

Leasing a tractor trailer is a significant decision that can impact your career in the trucking industry. At Apple Truck and Trailer, we understand the importance of this choice and are committed to helping you navigate the process with ease and confidence.

Our aim is not just to lease you a tractor trailer but to ensure that it becomes a stepping stone towards your success in the industry.

Contact us today at Apple Truck and Trailer. We offer a wide range of high-quality trucks and trailers suitable for various hauling needs. Our flexible leasing options are designed to meet the unique requirements of each driver, ensuring that you find the perfect match for your business model.

Whether you’re a seasoned driver or just starting out, our team is here to provide the support and guidance you need every step of the way.

Lease Success Tips

To ensure your leasing experience is as beneficial as possible, consider the following tips:

- Understand Your Lease: Before signing any agreement, make sure you fully understand the terms, including your monthly payments, maintenance responsibilities, and end-of-lease options. Knowledge is power, and understanding your lease inside out will help you make informed decisions throughout its duration.

- Stay Financially Prepared: Leasing a tractor trailer involves more than just monthly payments. Fuel, insurance, and maintenance costs can add up, so it’s crucial to manage your finances wisely. Setting aside money for unexpected expenses will help you maintain financial stability and peace of mind.

- Maintain Your Truck: Taking good care of your leased truck not only ensures it runs efficiently but also helps you avoid extra charges for wear and tear at the end of your lease. Regular maintenance checks and prompt repairs can save you money and extend the life of your truck.

- Plan for the Future: Whether your goal is to become an owner-operator or to expand your fleet, it’s important to have a long-term plan. Consider how leasing fits into your overall career goals and use it as a tool to move closer to achieving them.

- Communicate with Your Leasing Company: At Apple Truck and Trailer, we’re more than just a leasing company; we’re your partner in success. Don’t hesitate to reach out to us with any questions or concerns. We’re here to support you throughout your leasing journey.

For those interested in learning more about our leasing options and how we can help you succeed, visit our truck and trailer rental page. Our team is ready to assist you in finding the perfect leasing solution to meet your needs.

Leasing a tractor trailer is a significant step, but with the right preparation and support, it can be a rewarding one. At Apple Truck and Trailer, we’re committed to helping you achieve success in the trucking industry. Let’s embark on this journey together, with confidence and a clear path towards your goals. Happy trucking!

Frequently Asked Questions about Tractor Trailer Leasing

When considering how to lease a tractor trailer, it’s natural to have questions. Let’s dive into some of the most common queries to help you understand the process better.

Is leasing a tractor trailer a good idea?

Leasing a tractor trailer can be a smart move for many more truck drivers It offers flexibility, lower upfront costs, and the chance to drive newer models with the latest technology. If you’re not ready to commit to buying a truck or if your credit isn’t perfect, leasing provides a path to start driving and earning without the heavy financial burden of purchasing.

However, it’s important to consider your long-term goals and financial situation. Leasing might mean higher overall costs in the long run compared to buying a truck outright. Plus, you won’t own the truck at the end of the lease unless you opt for a lease-to-own program.

What are the requirements to lease a semi truck?

To lease a semi truck, there are a few key requirements:

- Commercial Driver’s License (CDL): You must have a valid CDL to lease a commercial truck.

- Credit Score: While the requirements can be more lenient than buying, a decent credit score can secure better lease terms.

- Driving Record: A clean or nearly clean driving record is essential. Companies want to lease to drivers who pose the least risk on the road.

- Proof of Income: You’ll need to demonstrate that you can make the monthly lease payments.

- Down Payment: Depending on the company and your credit, a down payment may be required, though 0-down options exist for some drivers.

How much does it cost to lease a semi truck?

The cost to lease a semi truck varies widely based on several factors:

- Credit Score: A higher credit score can lower your monthly payments.

- Down Payment: A larger down payment reduces your monthly costs.

- Lease Terms: The length of the lease and the specific truck model will affect your payments.

- Insurance and Maintenance: Don’t forget to factor in the cost of insurance and maintenance, which can add significantly to your monthly expenses.

On average, you might expect to pay anywhere from $1,600 to $2,500 per month for the lease itself, with additional costs for insurance, maintenance, and other fees. It’s crucial to get a full picture of the costs involved before signing a lease agreement.

Leasing a tractor trailer is a significant decision that can impact your financial future. Take the time to research, ask questions, and consider your options carefully. With the right approach, leasing a semi truck can be a valuable step toward achieving your goals in the trucking industry.

Let’s explore more about Apple Truck and Trailer and some tips for lease success.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, long haul trucking, and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.