Are you considering leasing a semi-truck? For many truck drivers in the commercial trucking industry, leasing offers a way to get behind the wheel of a semi-truck sooner with lower upfront costs compared to purchasing.

With a lease agreement, you can avoid a hefty down payment and instead make monthly payments that fit your cash flow and business expenses. Whether you’re a company driver looking to transition to an owner-operator or an experienced owner-operator seeking to upgrade your fleet, leasing a semi truck can be a viable option.

From balancing your balance sheet to exploring government programs for health insurance and saving money on fuel costs, leasing offers numerous benefits for many drivers in the trucking industry. However, it’s essential to consider factors like lease payments, maintenance purposes, and the length of the lease term before making a final decision.

Whether you’re a company driver or an owner-operator, leasing a semi-truck can provide the flexibility and financial advantages needed to succeed in the competitive world of commercial trucking.

Is Leasing a Semi-Truck a Good Idea?

Let’s break it down quickly for anyone in a rush:

- Lower Upfront Costs: Leasing a semi-truck typically requires less money upfront, making it more accessible for many businesses.

- Financial Security: With leasing, you get fixed payments and may benefit from warranty plans and maintenance support.

- Operating Newer Models: Leasing often means you can operate newer truck models, which can be more fuel-efficient and have the latest safety features.

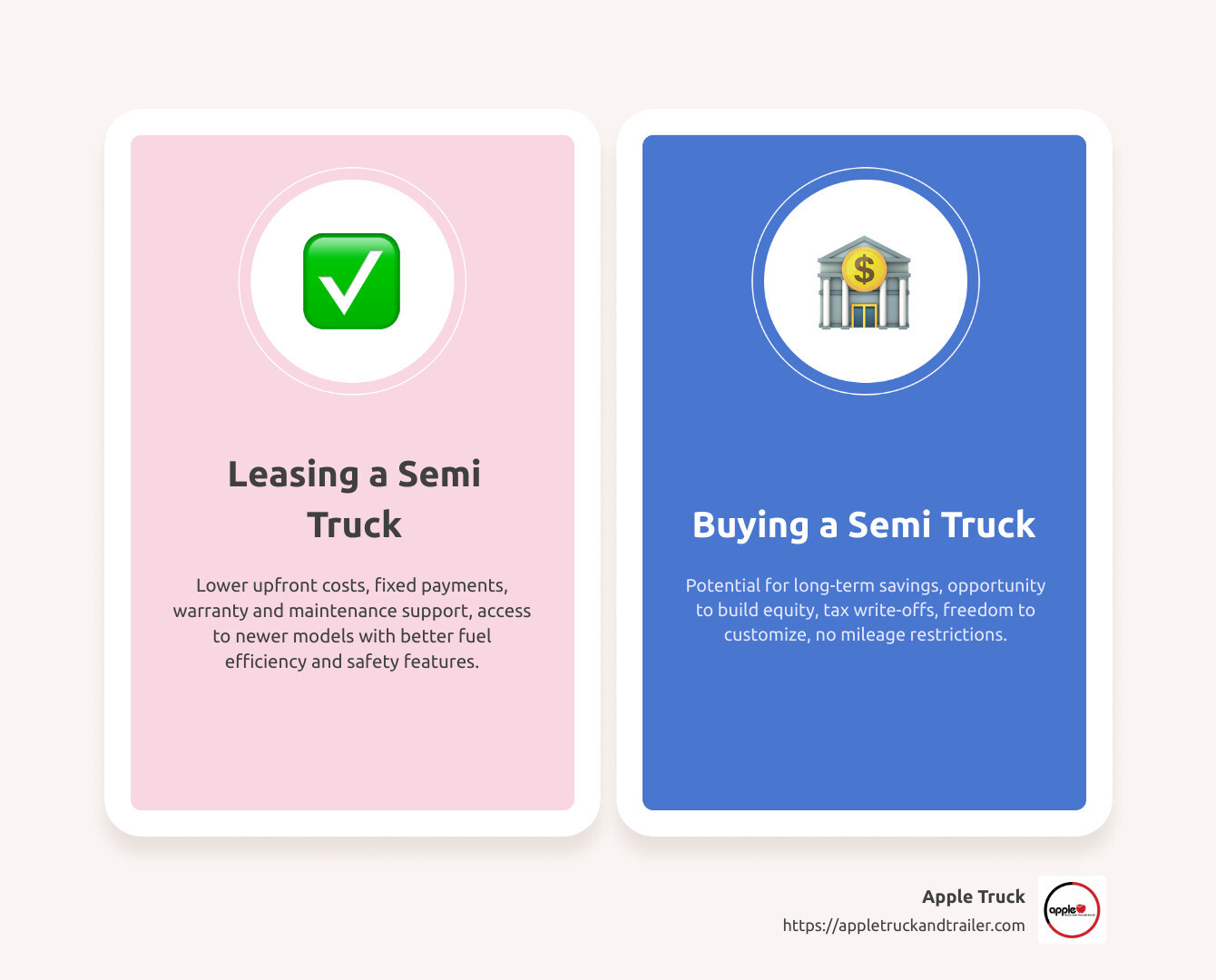

Leasing vs. Buying is a critical decision that can significantly impact your business’s cash flow and operational efficiency. On one hand, leasing a semi-truck can be an attractive option due to lower initial investment, financial security features like fixed payments, and the opportunity to operate a brand-new truck.

On the other hand, buying a truck outright can offer long-term savings, the chance to build equity and greater flexibility. Each option carries its own set of benefits and challenges, which we’ll explore to help you make the best decision for your specific needs and circumstances.

However, it’s crucial to consider that leasing might end up costlier in the long run and may offer less freedom regarding truck customization and usage.

Considering a semi-truck for your business in Massachusetts or surrounding areas involves weighing numerous financial considerations.

Table of Contents

Process of Leasing a Semi-Truck

When it comes to getting a semi-truck for your business, you might wonder, is leasing a semi-truck a good idea? Let’s break it down into three key points: lower upfront costs, financial security, and access to brand-new models. These aspects can help you decide if leasing fits your business model and financial situation.

Lower Upfront Costs

First up, leasing a semi-truck means you don’t need a big pile of cash right from the start. Unlike buying, where you might need to pay a hefty sum upfront or have a substantial down payment for financing, leasing comes with flexible credit options and often low-money down. This is great news if you’re just starting out or if your cash flow is better suited for other investments in your business.

Financial Security

Leasing offers a kind of safety net. How? Well, you have fixed payments. This means you know exactly how much you’re paying each month, making budgeting a breeze. Plus, many leases come with warranty plans and 24/7 maintenance support. These benefits reduce the risk of unexpected costs, providing a layer of financial security that buying outright might not offer.

Operating Newer Models

Here’s something exciting: leasing often lets you drive a brand-new truck. Why is this a big deal? New trucks are usually more fuel-efficient, have the latest safety features, and come with factory warranties. This not only means potential savings on fuel and maintenance but also a smoother, safer driving experience. And let’s be honest, operating a shiny new truck can also be a morale booster for you and your team.

So, is leasing a semi-truck a good idea? If you’re looking for a way to minimize initial costs, enjoy financial predictability, and drive the latest models without the full commitment of buying, leasing could be a smart choice for your business. It’s all about weighing these benefits against your long-term business goals and financial plans.

In the next section, we’ll dive deeper into the benefits of leasing a semi-truck, giving you a clearer picture of what to expect and how to make the most out of your lease agreement with a company like Apple Truck and Trailer.

Benefits of Leasing a Semi Truck

When considering if leasing a semi-truck is a good idea, it’s crucial to weigh the advantages it brings to your business. Leasing can offer lower upfront costs, financial security, and access to newer models with the latest features. Let’s break down these benefits to understand how they can impact your decision.

Lower Upfront Costs

One of the most appealing aspects of leasing is the flexible credit options and low-money down requirements. This is particularly beneficial for new owner-operators or those looking to expand their fleet without heavy initial investment. Companies like Apple Truck and Trailer provide leasing options that accommodate a range of credit scores and financial situations, making it easier to get started or grow your business.

- Flexible credit options mean that even if your credit isn’t perfect, you can still qualify for a lease.

- Low-money down helps conserve your cash flow, allowing you to allocate funds to other critical areas of your business.

Financial Security

Leasing a semi-truck also offers a degree of financial security not typically available when purchasing. With fixed payments, you can budget more effectively, knowing exactly what your truck-related expenses will be each month. Furthermore, many leases come with comprehensive warranty plans and maintenance support, significantly reducing the risk of unexpected repair costs.

- Fixed payments ensure that your monthly expenses are predictable, aiding in financial planning and stability.

- Warranty plans and maintenance support can cover a range of issues, from minor repairs to major mechanical failures, often with round-the-clock assistance.

Operating Newer Models

Another significant advantage of leasing is the opportunity to operate newer models of semi-trucks. These trucks often boast improved fuel efficiency, advanced safety features, and are covered by factory warranties. This not only helps in saving on fuel costs but also enhances the safety of your operations.

- Fuel efficiency is a key factor in reducing operational costs. Newer models are designed to consume less fuel, which can lead to significant savings over time.

- Safety features in newer trucks can include advanced braking systems, stability control, and other technologies that help prevent accidents, protecting your drivers and your investment.

- Factory warranties provide peace of mind, covering most repairs and maintenance work, often without additional costs.

In conclusion, leasing a semi-truck offers numerous benefits that can support the growth and stability of your business. From lower upfront costs to financial security, and the chance to operate newer, more efficient models, leasing provides a flexible and cost-effective solution for many trucking professionals. As you consider your options, companies like Apple Truck and Trailer are ready to work with you, offering tailored leasing solutions to meet your specific needs and goals.

Challenges of Leasing a Semi Truck

Leasing a semi-truck can seem like an attractive option for many, especially when considering the benefits such as lower upfront costs and access to newer models. However, it’s crucial to weigh these advantages against the potential challenges you might face. Let’s dive into some of these challenges.

Higher Long-term Costs

One of the most significant challenges of leasing a semi-truck is the higher long-term costs. While leasing offers lower upfront expenses, over time, the monthly payments can add up to more than the cost of purchasing a truck outright. It’s like renting a house; you pay every month but don’t own anything in the end. This aspect is vital to consider for anyone thinking, “Is leasing a semi truck a good idea?

Less Freedom

When you lease a semi-truck, you’re bound by the rules and restrictions set by the leasing company. This means less freedom to customize your truck or use it as you see fit. For example, there might be limits on the number of miles you can drive or restrictions on modifying the truck to suit your specific needs. This lack of freedom can be a significant drawback for drivers who prefer to tailor their trucks to their personal or business preferences.

Lease Agreements

Navigating lease agreements can be another challenge. These contracts are often complex and filled with fine print that can catch you off guard if you’re not careful. For instance, there might be penalties for ending the lease early, or unexpected costs for maintenance and repairs. Understanding every detail of the lease agreement is crucial to avoid surprises down the line.

In conclusion, while leasing a semi-truck offers several attractive benefits, it’s important to carefully consider the potential challenges. Higher long-term costs, less freedom, and complex lease agreements are significant factors that can impact your decision. As you weigh the pros and cons, companies like Apple Truck and Trailer are there to guide you through the process, helping you find the leasing option that best suits your needs and goals.

Moving on, let’s compare the differences between leasing and buying a semi-truck, focusing on aspects like building equity, flexibility and control, and the financial implications of each option.

Comparing Leasing and Buying

When deciding if leasing a semi-truck is a good idea, it’s crucial to understand how it stacks up against buying. Each option has its benefits and drawbacks, affecting your business in different ways. Let’s dive into the specifics.

Building Equity

Ownership benefits: When you buy a semi-truck, you’re investing in an asset for your business. Just like owning a home, every payment you make on your truck loan is a step toward full ownership. Once you’ve paid off the truck, it’s yours to keep, sell, or trade-in. This process allows you to build equity over time, which can be a significant financial asset for your business.

Tax write-offs: Both leasing and buying offer tax advantages, but they work differently. When you own a truck, you can capitalize on depreciation deductions, reducing your taxable income over the truck’s useful life. Additionally, the interest on your truck loan may also be tax-deductible, providing further financial relief.

Flexibility and Control

Customization: Owning your semi-truck means you can customize it to meet your specific needs, whether that’s for comfort, efficiency, or branding purposes. This freedom allows you to tailor your truck to better serve your business and personal preferences, something that’s typically restricted when leasing.

No mileage restrictions: Buying a truck frees you from the mileage limits often imposed by leasing agreements. This flexibility is crucial for businesses with fluctuating demands or those looking to expand their service areas without worrying about exceeding lease terms.

Financial Implications

Long-term savings: While leasing offers the allure of lower upfront costs, purchasing a semi-truck can be more cost-effective in the long run. Once you’ve paid off your truck, you eliminate the monthly payment, reducing your operational costs. This ownership also means you’re not paying to use someone else’s asset; you’re investing in your own business.

Upfront costs: One of the most significant barriers to buying a semi-truck is the initial investment. Purchasing a truck requires a substantial down payment plus the ongoing costs of loan repayments, which can be more than a lease payment. However, financing options are available to help manage these costs, and the long-term benefits of ownership can outweigh these initial financial hurdles.

In conclusion, whether leasing or buying a semi-truck is the better option depends on your business’s current financial situation, future growth plans, and how much control and flexibility you want over your equipment. For those looking for lower upfront costs and less financial risk, leasing might be the way to go. However, if building equity and having complete control over your truck are priorities, purchasing could be the better long-term investment. Companies like Apple Truck and Trailer are ready to help you explore your options and make the best decision for your business.

Conclusion

When it comes to deciding whether leasing a semi-truck is a good idea for you, the most important step is evaluating your needs. Every business has unique demands, goals, and financial situations. For some, the lower upfront costs, financial predictability, and access to newer models that come with leasing are exactly what they need to thrive. For others, the benefits of ownership, such as building equity and having complete control over the vehicle, might outweigh the advantages of leasing.

Leasing a semi-truck can offer a world of opportunity – from financial flexibility to peace of mind with maintenance and warranty plans. However, it’s not a one-size-fits-all solution. By taking the time to carefully consider your operational needs, financial situation, and long-term goals, you can determine if leasing aligns with your business strategy.

The true value of a semi-truck, whether leased or owned, lies in its ability to efficiently and effectively meet the needs of your business. At Apple Truck and Trailer, we’re committed to helping you find the right solution, offering a variety of leasing options designed to keep your business moving forward. Explore our leasing opportunities and discover how we can help you drive your business towards success.

Contact us today at Apple Truck and Trailer, we understand the complexity of this decision. We’re here to help you navigate through your options, providing clear, simple advice that aligns with your specific business needs. Our team of experts is dedicated to ensuring you have all the information you need to make a choice that will benefit your business in the long run.

Frequently Asked Questions about Leasing a Semi Truck

When considering the leap into leasing a semi-truck, you likely have a bevy of questions. Let’s tackle some of the most common inquiries to help demystify the process and highlight how leasing from a reputable company like Apple Truck and Trailer can be a strategic move for your trucking career or business.

What Are the Financial Benefits of Leasing Over Buying?

Lower Upfront Costs: The most immediate benefit of leasing is the significantly lower initial investment required. Unlike purchasing, where a hefty down payment is often necessary, leasing can get you behind the wheel with little to no money down. For those with less-than-perfect credit, leasing offers a more accessible path to securing a truck.

Predictable Monthly Payments: Leasing provides the advantage of fixed monthly payments. This predictability aids in budgeting and financial planning, without the surprise costs that can come with ownership, like unexpected repairs or maintenance.

Access to Newer Models: Leasing often allows drivers to operate newer models than they might afford if purchasing outright. Newer trucks often mean better fuel efficiency and fewer maintenance issues, which can translate to cost savings over time.

How Does Leasing Affect My Ability to Customize the Truck?

Leasing a semi-truck typically comes with restrictions on customization. Since the truck is not your property, modifications that alter its appearance or functionality are often limited or prohibited. This can be a downside for drivers who wish to personalize their rigs extensively. However, leasing companies may offer various models and specs to choose from, allowing you to select a truck that best fits your needs without needing modifications.

Can I Eventually Own the Truck I Lease?

Yes, in many lease agreements, there is an option to buy the truck at the end of the lease term. This option can be a path to ownership for drivers who may not have the capital to purchase a truck outright initially. The terms of this purchase option vary, so it’s crucial to understand the specifics of your lease agreement. Some agreements may apply a portion of your lease payments toward the purchase price, while others might offer the truck at a residual value.

Conclusion: Leasing a semi-truck can be a financially savvy choice, offering lower upfront costs, financial predictability, and the opportunity to operate newer models. While customization options may be limited, the potential to eventually own the truck provides a clear path toward long-term investment in your trucking career.

As always, carefully review the terms of any lease agreement and consider how it aligns with your personal and business goals. Companies like Apple Truck and Trailer are equipped to guide you through this process, ensuring you make an informed decision that suits your needs.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, semi trailer trucks, and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.