How much does it cost to lease a box truck? If you’re seeking a quick answer, here are some key insights:

- Base Monthly Payments: Expect $775–$995, depending on your credit score.

- Initial Costs: Deposit, first month’s payment, and insurance can reach $3,000–$12,000.

- Additional Expenses: Be prepared for fuel, maintenance, and possible licensing fees.

Leasing a box truck offers a cost-effective solution for businesses needing reliable transportation. It’s particularly appealing for startups, as leasing helps manage cash flow by minimizing upfront costs.

Leasing also avoids the burden of purchasing costs, allowing funds to be used elsewhere in your business operations.

Understanding the specific needs of your venture should be the first step. Consider factors like lease length, potential mileage restrictions, and the costs involved. These details play a crucial role in ensuring your investment aligns with your financial capacity and logistical demands.

I’m Michael Sensano, passionate about helping businesses make informed leasing decisions. With expertise in how much does it cost to lease a box truck, I aim to guide you through the intricacies of leasing, making it straightforward and profitable for your business.

Table of Contents

Understanding Box Truck Leasing Costs

When you’re considering leasing a box truck, several financial factors come into play. Let’s break them down to help you understand how they affect your overall expenses. It is crucial to understand the financial aspects such as monthly payments, down payments, interest rates, and additional fees, and to negotiate favorable terms before signing the lease agreement.

Credit Score Impact

Your credit score is a key player in determining how much it costs to lease a box truck. A higher score means lower monthly payments. For instance, businesses with good credit can start with payments around $775 per month. On the flip side, if your credit is less than stellar, expect to begin at $995 per month.

Monthly Payments

Monthly payments, or lease payments, depend on several elements, including your credit score, the truck’s model, and the lease term. Typically, longer lease terms result in lower monthly payments. However, it’s important to balance the lease length with your business needs.

Down Payment

Most leases require a down payment. This initial cost is often a percentage of the truck’s value. A larger down payment can reduce your monthly payments, easing your cash flow.

Interest Rates

Interest rates are another crucial factor. They vary based on your credit profile and the leasing company’s policies. A lower interest rate means you’ll pay less over the life of the lease.

Fees and Charges

Leasing isn’t just about the base price. Be aware of additional fees like taxes, insurance, and maintenance costs. Some leases might include a cents-per-mile maintenance fee, which covers repairs and upkeep. Knowing these fees upfront helps in budgeting accurately.

By grasping these elements, you can make a well-informed decision that aligns with your business’s financial goals. Leasing allows you to manage expenses efficiently, ensuring your transportation needs are met without straining your budget.

Next, we’ll explore the factors influencing box truck lease prices, helping you choose the best option for your business needs.

Factors Influencing Box Truck Lease Prices

When deciding to lease a box truck, several key factors will influence the overall cost. Understanding these can help you make a smart financial decision.

Additionally, considering a box truck rental can offer a versatile solution for transporting goods, with various configurations available to meet different hauling needs.

Truck Size

The size of the truck plays a significant role in determining how much it costs to lease a box truck. Larger trucks, including various types of box trucks, typically have higher lease prices due to their increased cargo capacity and utility. For instance, a 26-foot box truck offers ample space, making it a popular choice for businesses needing to transport large loads. However, this size comes with a higher leasing cost compared to smaller trucks.

Lease Term

The length of the lease term is another critical factor. Generally, longer lease terms result in lower monthly payments. For example, a 60-month lease will usually have smaller monthly payments than a 24-month lease. However, a longer lease also means a longer commitment, which might not be ideal if your business needs change frequently.

Location

Where you lease the truck can also impact the cost. Lease prices can vary based on geographic location due to differing demand and market conditions. For example, leasing in a high-demand urban area might be more expensive than in a rural setting. Always consider the local market when evaluating lease offers.

Credit Profile

Your credit profile is crucial in determining lease costs. A strong credit score can secure lower interest rates and monthly payments. As noted earlier, businesses with good credit can start with payments around $775 per month. Conversely, those with a lower credit score might face starting payments of around $995 per month. Maintaining a healthy credit profile can save significant money over the lease term.

Understanding these factors will help you steer the leasing process more effectively. By considering truck size, lease term, location, and your credit profile, you can find a lease that aligns with your business’s needs and budget.

Next, we’ll dig into how to choose the right box truck for your business, ensuring you get the most value from your lease.

How to Choose the Right Box Truck for Your Business

Selecting the right box truck for your business is crucial. It ensures you get the best value and efficiency from your lease. Here are some key factors to consider:

Payload Capacity

Payload capacity is the maximum weight a truck can safely carry, including cargo and passengers. It’s important to match the truck’s payload capacity to your business needs. For example, if you’re transporting heavy equipment, you’ll need a truck with a higher payload capacity to avoid overloading.

GVWR (Gross Vehicle Weight Rating)

The Gross Vehicle Weight Rating (GVWR) is the total weight a truck can handle, including its own weight plus the payload. A higher GVWR means the truck can carry more weight safely. Make sure the GVWR aligns with your business requirements to ensure safety and compliance with regulations.

Cargo Capacity

Cargo capacity refers to the physical space available for your goods. A larger cargo space allows you to transport more items in one trip, which can be more efficient for your business. For instance, a 26-foot box truck offers a substantial cargo capacity, ideal for large deliveries or moves.

Diesel Engine

Choosing a truck with a diesel engine can offer benefits such as better fuel efficiency and longer engine life compared to gasoline engines. Diesel engines are often preferred for their durability and cost-effectiveness, especially for businesses with high mileage needs.

Maintenance Coverage

Maintenance coverage is an important aspect of leasing reliable vehicles like box trucks. Many lease agreements include maintenance costs, which can save you from unexpected expenses. For example, some leases offer a fixed cents-per-mile charge that covers maintenance, allowing you to budget more accurately.

When choosing a box truck, consider these factors to ensure it meets your business needs. By focusing on payload capacity, GVWR, cargo capacity, diesel engine, and maintenance coverage, you can make an informed decision that maximizes the benefits of your lease.

Next, we’ll compare lease and purchase options, helping you decide which path is best for your business.

Comparing Lease vs. Purchase Options

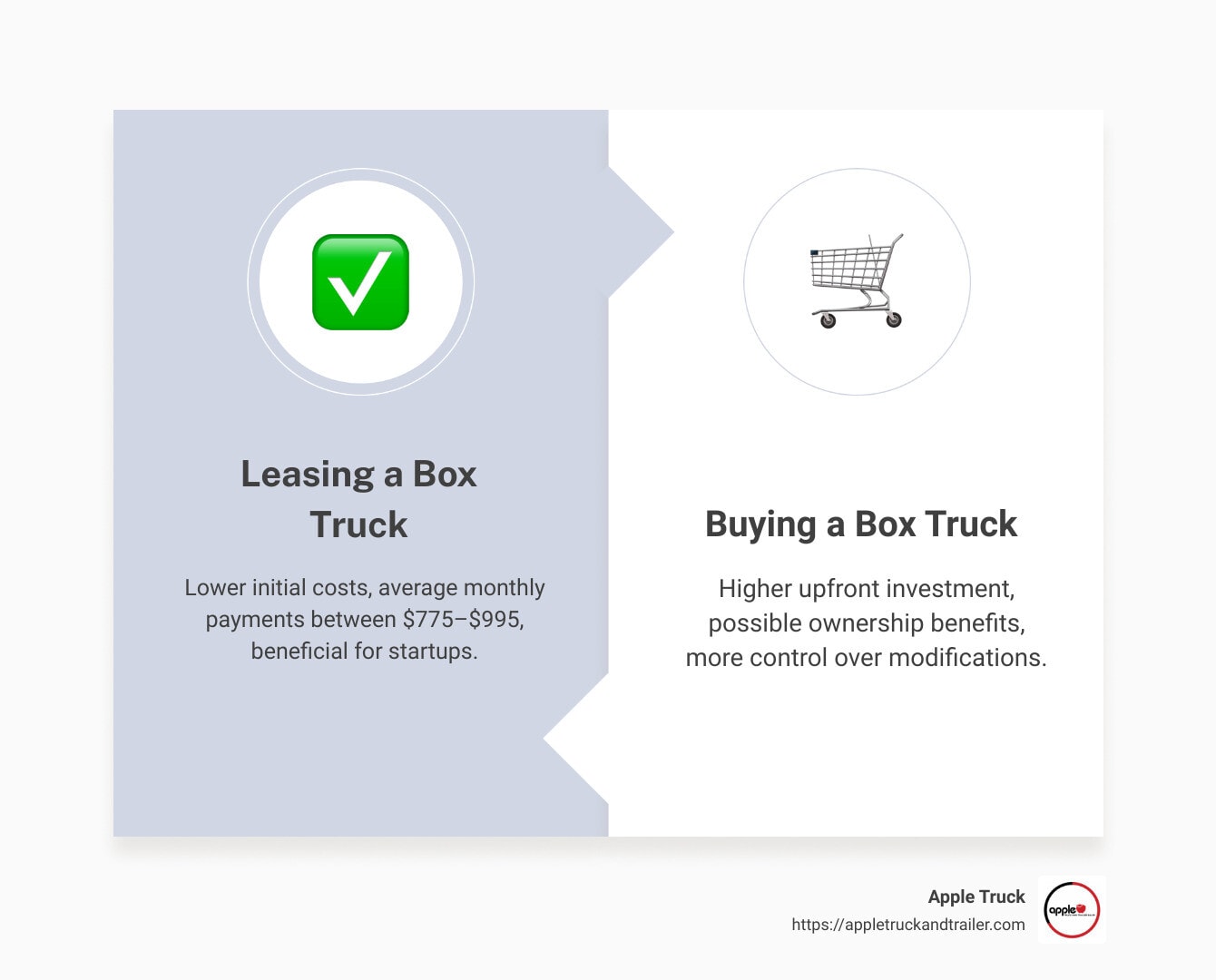

When deciding between leasing and purchasing a box truck, weigh the pros and cons of each option. Let’s break down the key differences in terms of upfront costs, monthly expenditures, maintenance responsibilities, and ownership benefits.

Upfront Costs

Leasing a box truck often requires lower initial costs compared to purchasing. Typically, you’ll need to cover a security deposit and the first month’s payment. This can range from $1,500 to $5,000. On the other hand, buying a truck usually demands a down payment, often 20% of the truck’s purchase price. For a $95,000 truck, that’s $19,000 upfront. If cash flow is tight, leasing can be a more accessible option.

Monthly Expenditures

With leasing, you’ll have predictable monthly payments. For instance, leasing a 20-foot box truck might cost around $2,000 per month. This includes maintenance fees, often charged per mile driven. In contrast, purchasing involves loan repayments. For a $95,000 truck financed over seven years at a 5% interest rate, expect payments of about $1,350 monthly. However, maintenance costs are your responsibility when you own the truck.

Maintenance Responsibilities

Leasing offers the convenience of included maintenance. For example, a flat rate of 8.5 cents per mile might cover all upkeep, protecting you from unexpected repair costs. When you own the truck, you’re responsible for all maintenance. Historical data shows maintenance costs can average around 10 cents per mile, but this can vary. If your business prefers predictability and less hassle, leasing might be the better choice.

Ownership Benefits

Owning a truck means building equity. Once the loan is paid off, the truck is yours to keep, sell, or trade. This can be a significant asset for your business. Leasing, however, doesn’t offer ownership. At the end of a lease, you return the truck. Some leases have a buyout option, allowing you to purchase the truck for a nominal fee or a percentage of its original price, like $1 or 10%.

Choosing between leasing and purchasing depends on your business’s financial situation and long-term goals. If upfront costs and maintenance predictability are priorities, leasing might be the way to go. But if building equity and owning an asset are more important, purchasing could be more beneficial.

Conclusion

At Apple Truck and Trailer, we understand the complexities involved in deciding whether to lease or purchase a box truck. Our commitment is to make this process as simple and seamless as possible for your business.

Why Choose Apple Truck and Trailer?

Since 1986, we have been a trusted partner in the truck and trailer industry. Our wide selection of high-quality trucks and trailers, combined with exceptional customer service, sets us apart. Whether you’re a startup or an established business, we offer flexible leasing options custom to your specific needs.

Leasing a box truck can be an excellent choice for businesses looking for cost-effective and flexible solutions. With leasing, you can avoid hefty upfront costs and enjoy predictable monthly payments. Plus, maintenance is usually covered, saving you from unexpected expenses.

We are proud to serve Massachusetts, Rhode Island, Connecticut, and New Hampshire, providing reliable and efficient transportation solutions. Our experienced team is here to guide you through every step, ensuring you get the best deal possible.

Contact us today at Apple Truck and Trailer, we’re here to help you make an informed decision that aligns with your operational goals. Let us be your partner in success. Choosing the right box truck lease is crucial for your business.

For more information on our leasing options and to explore how we can meet your business needs, visit our Truck Leasing page.

Frequently Asked Questions about Box Truck Leasing

What credit score is needed to lease a box truck?

Your credit score plays a crucial role in leasing a box truck. Generally, a [credit score of 650 or above](https://www.quora.com/search?q=how much does it cost to lease a box truck) is considered good and can help you secure better lease terms. Lenders look for a history of timely payments and some experience with vehicle loans, often referred to as “comp borrowing.” If your credit score is lower, you might still qualify for a lease, but expect to face higher interest rates and monthly payments.

Is leasing a truck from a company worth it?

Leasing a truck can be a smart choice for many businesses. It offers flexibility and lower upfront costs compared to buying. You avoid the large down payment required for purchasing and gain the advantage of predictable monthly payments.

Leasing also includes maintenance, reducing unexpected expenses. However, keep in mind that leases often come with mileage limits and potential fees for excessive wear and tear. If your business needs change frequently, leasing provides the flexibility to upgrade to newer models without the commitment of ownership.

What is the largest moving truck you can rent?

When it comes to renting, a 26-foot box truck is typically the largest available. These trucks are ideal for moving large loads and can hold up to 24 standard-sized pallets. A 26-foot truck usually has a width of 8 feet, making it suitable for various cargo needs. When planning your rental, consider the truck’s fuel efficiency.

Diesel-powered models can travel up to 12 miles per gallon, while gasoline models cover about 8-10 miles per gallon. Always check with the rental company for specific dimensions and capacities, as they can vary by make and model.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas, and Boston. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, semi trailer trucks, semi trucks and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.