Understanding Tractor Trailer Leasing Costs

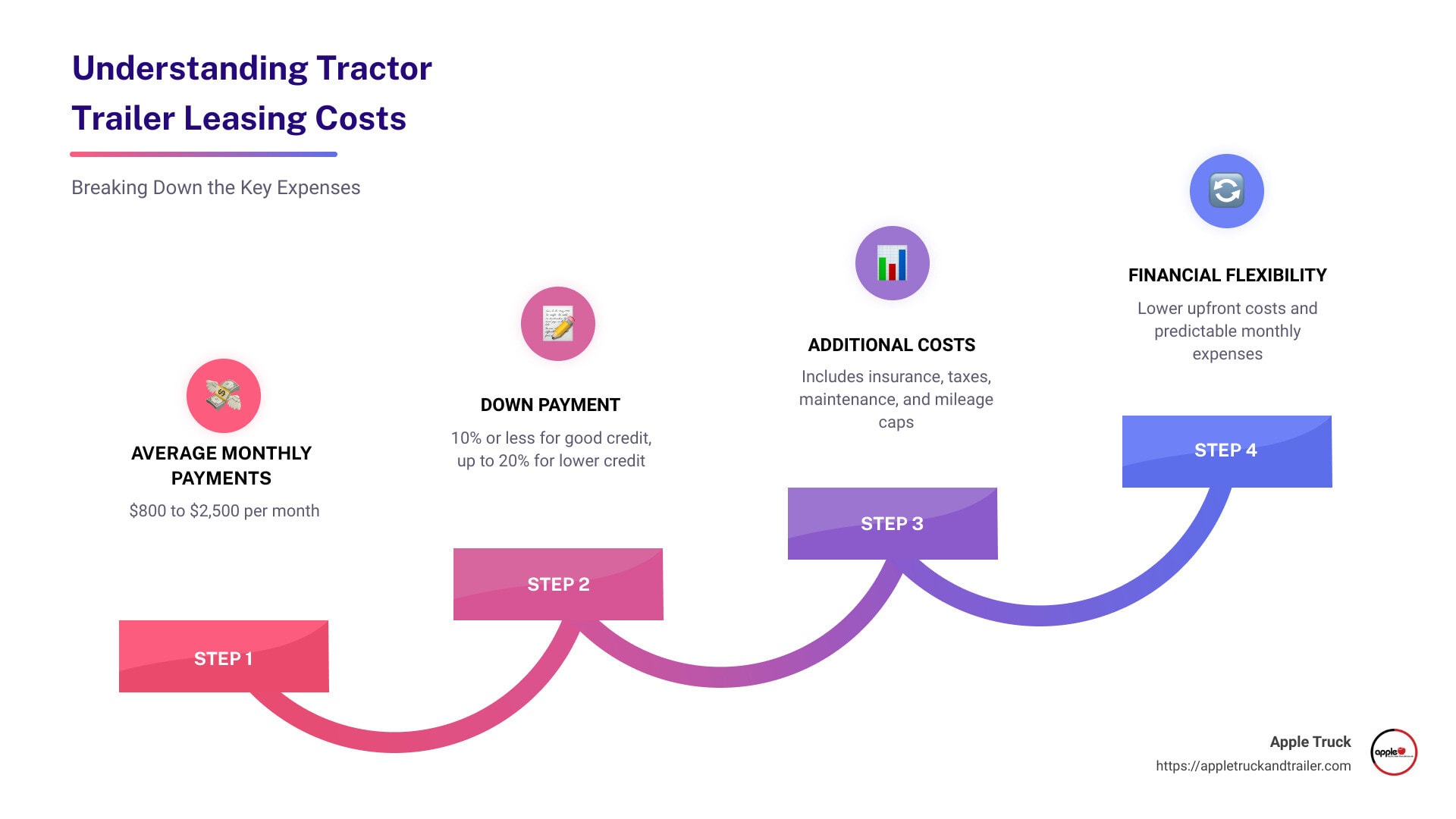

How much does it cost to lease a tractor trailer? Whether you’re a small business owner or an individual in need of reliable transport solutions, understanding the costs involved, including semi truck costs, can be daunting. Here’s a quick breakdown of the key expenses:

- Average Monthly Payments: Ranges from $800 to $2,500.

- Down Payment: Typically 10% or less for good credit, upwards of 20% for lower credit scores.

- Additional Costs: Includes insurance, taxes, maintenance, and mileage caps.

Leasing a tractor trailer can offer significant financial flexibility. Unlike buying, leasing often requires lower upfront costs and provides predictable monthly expenses. This makes it an attractive option for many small businesses and individuals managing tight budgets.

At Apple Truck and Trailer, we prioritize transparent, straightforward leasing options. Our goal is to support you with exceptional customer service, helping you steer the complexities of leasing and focus on growing your business.

I’m Michael Sensano, with experience in the truck and trailer industry. I am here to guide you through understanding how much does it cost to lease a tractor trailer and ensure you find a solution that meets your needs.

Table of Contents

What Does It Mean to Lease a Tractor Trailer?

Leasing a tractor trailer, also known as a semi truck lease, means renting it for a specific period while paying a monthly fee. Unlike buying, leasing allows you to use the trailer without the responsibilities of ownership. This arrangement can be particularly beneficial for businesses that need flexibility or have tight budgets.

Leasing Definition

When you lease a tractor trailer, you enter into a contract with a leasing company. This contract outlines the rental period, monthly payments, and other terms. Essentially, you get to use the trailer for business operations without having to buy it outright.

Understanding semi truck financing options is also crucial, as it can impact your overall leasing costs and terms.

Rental Period

Leasing periods can vary. Short-term leases might be just a few months, ideal for seasonal needs. Long-term leases can last several years, providing stability for ongoing operations.

Monthly Fee

The monthly fee you pay is based on several factors, including the age and condition of the trailer, the length of the lease, and the leasing company’s rates. Generally, newer trailers cost more to lease than older ones due to their higher market value and advanced features.

Ownership Hassles

One of the biggest advantages of leasing is avoiding the hassles of ownership. When you lease, you don’t have to worry about the trailer’s resale value, long-term maintenance, or significant upfront costs. This can free up capital and reduce financial risk for your business.

For example, at Apple Truck and Trailer, we offer flexible leasing options custom to meet your business needs, whether you need a trailer for a short-term project or a long-term commitment. This flexibility allows you to focus on running your business rather than managing equipment. For owner operators, leasing can provide a pathway to enter the industry without the burden of significant upfront investment.

How Much Does It Cost to Lease a Tractor Trailer?

Leasing a tractor trailer can be a smart move for your business, but it’s important to understand the semi truck costs involved. Let’s break down the average monthly costs and additional expenses you might face.

Average Monthly Lease Payments

The cost to lease semi trucks varies greatly depending on whether you’re leasing a new or used trailer.

- New Trailers: Leasing a new trailer typically costs between $1,600 and $2,500 per month. These trailers have the latest features and are less likely to require maintenance.

- Used Trailers: Leasing a used trailer can range from $800 to $1,600 per month, depending on the age and condition. While cheaper, used trailers might need more maintenance.

Cost Factors

Several factors influence these costs:

- Age of the Trailer: Newer trailers cost more due to their higher market value and updated technology.

- Condition: Well-maintained trailers are more reliable and can command higher lease prices.

- Lease Term: Longer leases often have lower monthly payments but may cost more overall.

- Leasing Company: Rates can vary, so it’s wise to compare offers from different providers.

Additional Expenses

Leasing a tractor trailer isn’t just about the monthly payment. There are other costs to consider:

- Insurance: You’ll need commercial truck insurance, which can be pricey. Rates vary based on coverage and your driving record.

- Taxes: Depending on your location, you might have to pay sales tax on the lease.

- Maintenance: While leasing companies often handle major repairs, you might be responsible for routine maintenance.

- Mileage Caps: Some leases have mileage limits. Exceeding these can result in additional charges.

Understanding these costs helps you plan your budget and avoid surprises. Leasing can offer financial flexibility, but it’s crucial to consider all expenses to make an informed decision.

Next, we’ll dive into the benefits of leasing a tractor trailer and how it can provide financial flexibility and operational advantages for your business.

Benefits of Leasing a Tractor Trailer

Leasing a tractor trailer can be a game-changer for your business. It offers financial flexibility and operational advantages that can help you grow without the heavy burden of ownership. Let’s explore these benefits in detail. Leasing is particularly advantageous in the trucking industry, where flexibility and financial predictability are crucial.

Financial Flexibility

Lower Upfront Costs

One of the biggest advantages of leasing is the lower upfront costs. Unlike purchasing, which often requires a substantial down payment, leasing typically has minimal initial investment. This means you can allocate more of your capital to other critical areas of your business.

Predictable Expenses

Leasing provides predictable monthly expenses, which simplifies budgeting. Knowing exactly what your transportation costs will be each month helps you plan better and avoid unexpected financial hits.

Improved Cash Flow

With lower upfront costs and predictable monthly payments, leasing improves your cash flow. You can keep more money in your pocket, which can be used to invest in other growth opportunities or to manage day-to-day operations more effectively.

Maintenance and Upgrades

Less Maintenance

Leasing a tractor trailer usually means you’re getting a newer model, which requires less maintenance. Plus, many leasing companies include maintenance services in the lease agreement. This can save you both time and money, allowing you to focus on your core business activities.

Easy Upgrades

Leasing offers the flexibility to upgrade your equipment easily. As your business grows or your needs change, you can switch to newer or more suitable models without the hassle of selling the old ones. This ensures you always have the best tools for the job.

No Depreciation

When you lease, you don’t have to worry about the depreciation of the tractor trailer. Depreciation is a significant concern when you own the equipment, as it reduces the resale value over time. Leasing eliminates this worry, letting you return the trailer at the end of the lease term and upgrade to a new one if needed.

Focus on Business

Leasing frees you from the headaches of ownership, such as resale value concerns and major repairs. This allows you to focus on what you do best—running and growing your business. You can concentrate on delivering excellent service to your customers without being bogged down by equipment issues.

Next, we’ll discuss the requirements to lease a tractor trailer, including the necessary experience, paperwork, and how to create a solid business plan and budget.

Requirements to Lease a Tractor Trailer

Experience and Paperwork

Before leasing a tractor trailer, you need to meet certain requirements. First, experience is essential. Most leasing companies prefer that you have a minimum of 2 years of trucking experience. This ensures you have the necessary skills and knowledge to handle the responsibilities of leasing and operating a tractor trailer.

Next, you’ll need to get your paperwork in order. Here’s a checklist of the essential documents:

- Insurance: Make sure you have the right insurance coverage. This includes liability, cargo, and physical damage insurance.

- USDOT Number: You must have a valid USDOT number if you plan to operate across state lines.

- MC Number: If you’re running as an independent operator, you may need a Motor Carrier (MC) number.

- IFTA: The International Fuel Tax Agreement (IFTA) is necessary for fuel tax reporting.

- Permits and Registrations: Depending on the states you operate in, you might need additional permits and registrations.

Business Plan and Budget

Creating a thorough business plan is crucial. Your business plan should outline the type of freight you intend to haul. Will you lease a truck to work with a specific company, or do you plan to operate independently? This will help you make informed decisions about your lease.

In addition to your business plan, you need a clear budget. Here’s what to include:

- Freight Type: Define the type of freight you will haul. This can affect your costs and the type of truck you need.

- Down Payment: Determine how much you can afford for a down payment. Some leases may offer low or no down payment options.

- Monthly Payments: Know your monthly lease payments. For new trailers, this can range from $1,600 to $2,500per month. Used trailers typically cost between $800 and $1,600 per month.

- Insurance and Taxes: Include the costs of insurance and taxes in your budget.

- Maintenance: Plan for maintenance costs. While leasing often includes maintenance, you may still need to budget for minor repairs.

A solid business plan and budget will help you avoid overextending yourself and ensure you can meet your financial obligations.

Next, we’ll dive into tips for getting the best lease deal, including how to shop around, compare terms, and understand mileage caps.

Tips for Getting the Best Lease Deal

Shopping Around

To get the best lease deal, start by shopping around. Different leasing companies offer various terms and prices. Don’t settle for the first offer you get. Talk with several leasing companies to understand what each one provides.

- Compare Prices: Look at the cost of leasing similar tractor trailers from different companies.

- Check Terms and Conditions: Some leases might have hidden fees or unfavorable terms.

- Assess Customer Service: A company with good customer service can save you headaches down the road.

Understanding Lease Terms

Understanding lease terms is crucial. Here are key factors to consider:

- Mileage Caps: Most leases have mileage limits. Exceeding these limits can result in costly fees. For example, excess mileage fees can range from 15 to 50 cents per mile.

- Maintenance Policies: Know who is responsible for maintenance and repairs. Some leases include maintenance, while others do not.

- Additional Charges: Be aware of any potential extra costs, such as early termination fees or charges for excess wear and tear.

Compare Prices, Terms, and Conditions

When comparing leases, look at the whole picture:

- Monthly Costs: New trailers can cost between $1,600 and $2,500 per month, while used ones range from $800 to $1,600.

- Down Payments: Some leases require a down payment, while others do not.

- Insurance and Taxes: Factor in the costs of insurance and taxes.

- Maintenance: Consider whether maintenance is included or if you need to budget for it separately.

Mileage Caps

Mileage caps are a common feature in lease agreements. They limit the number of miles you can drive without incurring additional fees.

- Estimate Your Mileage: Before signing a lease, estimate how many miles you will drive. This helps you choose a lease that fits your needs.

- Understand the Fees: Know the cost per mile if you exceed the cap. This can help you budget more accurately.

Maintenance Policies

Maintenance policies can vary widely between leasing companies.

- Included Maintenance: Some leases cover all maintenance costs, which can save you money and hassle.

- Out-of-Pocket Costs: If maintenance is not included, budget for regular upkeep and unexpected repairs.

- Documentation: Keep all maintenance records. This can help avoid disputes with the leasing company.

Additional Charges

Be aware of any extra charges that might come with your lease.

- Early Termination Fees: If you need to end your lease early, there could be significant penalties.

- Excess Wear and Tear: Leases often include fees for excessive wear and tear. Understand what is considered “excessive” to avoid unexpected costs.

By carefully comparing prices, terms, and conditions, and understanding mileage caps and maintenance policies, you can find a lease that best suits your needs and budget. This approach will help you avoid hidden fees and ensure a smooth leasing experience.

Next, we will address some frequently asked questions about leasing a tractor trailer.

Conclusion

Leasing a tractor trailer can be a smart financial move, especially for businesses looking to maintain flexibility and predictability in their expenses. With monthly costs ranging from $800 to $2,500, and various options for new and used trailers, leasing offers a custom solution to fit different budgets and operational needs.

Contact us today at Apple Truck and Trailer. We pride ourselves on providing transparent and straightforward leasing options. Our team of experienced truck and trailer specialists is dedicated to helping you find the best fit for your business. From understanding lease terms to ensuring you have all necessary paperwork in order, we’re here to support you every step of the way.

For more information on leasing a tractor trailer and to explore our comprehensive services, visit our Truck Leasing page.

If you have any questions or need personalized assistance, don’t hesitate to contact us. We’re committed to providing the best service and the highest level of communication to all our customers.

Apple Truck and Trailer – Your trusted partner in truck and trailer leasing.

Frequently Asked Questions about Leasing a Tractor Trailer

Is Leasing a Tractor Trailer a Good Idea?

Leasing a tractor trailer can be a smart move for many businesses. Here’s why:

- Lower Initial Costs: Unlike purchasing, leasing often requires a smaller upfront investment. This is great if cash flow is a concern. For example, leasing a used trailer can cost between $800 to $1,600 per month, while new trailers might range from $1,600 to $2,500 per month.

- Financial Flexibility: Leasing provides financial flexibility by preserving capital for other essential operations. This is especially important for businesses with less-than-perfect credit. Leasing companies often have different credit requirements than traditional loans, making it easier to access newer or more reliable equipment.

- Predictable Expenses: Leasing comes with predictable monthly payments, which helps in budgeting and financial planning. You avoid unexpected expenses like major repairs and depreciation.

What Are the Benefits of Semi Truck Leasing?

Leasing a semi truck, also known as a semi truck lease, offers several advantages:

- No Depreciation: When you lease, you don’t have to worry about the truck losing value over time. This means you can focus on your business without the headache of declining asset value.

- Lower Upfront Costs: Leasing usually requires a lower down payment compared to buying. This makes it easier for businesses to get started without a huge initial outlay.

- Predictable Expenses: With leasing, your monthly payments are fixed. This helps in maintaining a stable budget and avoiding unexpected costs.

- Easy Upgrades: Leasing allows you to upgrade to newer models more frequently. This ensures your fleet is always equipped with the latest technology and safety features.

What Are the Requirements to Lease a Semi Truck?

Leasing a semi truck involves meeting certain requirements:

- Experience: Most leasing companies prefer drivers with some experience. This ensures that the lessee can handle the vehicle and understand the responsibilities involved.

- Paperwork: Be prepared to provide necessary documents like proof of income, insurance, USDOT number, and other permits and registrations. Having all paperwork in order speeds up the leasing process.

- Business Plan: A thorough business plan helps in making informed decisions about your lease. It should include the type of freight you intend to haul, whether you want to lease from/to a specific company, or if you aim to be an independent driver.

- Budget: Know your budget inside and out. This helps in avoiding overextension with high payments and ensures that you can manage your lease comfortably.

Leasing a tractor trailer can be a financially sound decision for many businesses, offering lower initial costs, financial flexibility, and predictable expenses. Understanding the requirements and benefits can help you make the best choice for your business needs.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, semi trailer trucks, semi trucks and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.