When exploring tractor trailer lease cost, it’s crucial to grasp the factors that influence these expenses to ensure you make a financially sound decision for your business. The cost of leasing a tractor trailer can vary significantly based on several factors including the age of the trailer, lease terms, and the company you choose to lease from.

Leasing a tractor trailer offers numerous benefits for small to medium-sized businesses, especially those in logistics, fleet management, or needing temporary storage solutions. This arrangement provides an opportunity to utilize high-quality, reliable trailers without the hefty initial investment of purchasing. Additionally, leasing allows businesses the flexibility to upgrade or change equipment as their needs evolve, without worrying about resale value or long-term maintenance costs.

Scope of Tractor Trailer Leasing

Leasing options can range from short-term rentals to long-term commitments, each suitable for different business needs and budget constraints. Whether you are seeking to increase your fleet capacity for a peak season or need a specialized trailer for a specific job, understanding the lease cost implications is fundamental.

Table of Contents

Understanding Tractor Trailer Lease Costs

When considering a tractor trailer lease, understanding the costs associated with leasing a semi truck is crucial for financial planning. This section breaks down the factors that influence lease costs and provides insight into the average monthly expenses for new and used trailers.

Understanding the leasing process is essential to grasp the factors influencing lease costs.

In the discussion about new trailers, it’s important to specify that the costs provided are for leasing a new semi truck.

The insights provided in this section will help businesses make informed decisions regarding semi truck leases, highlighting the importance of understanding the costs and benefits of leasing versus buying.

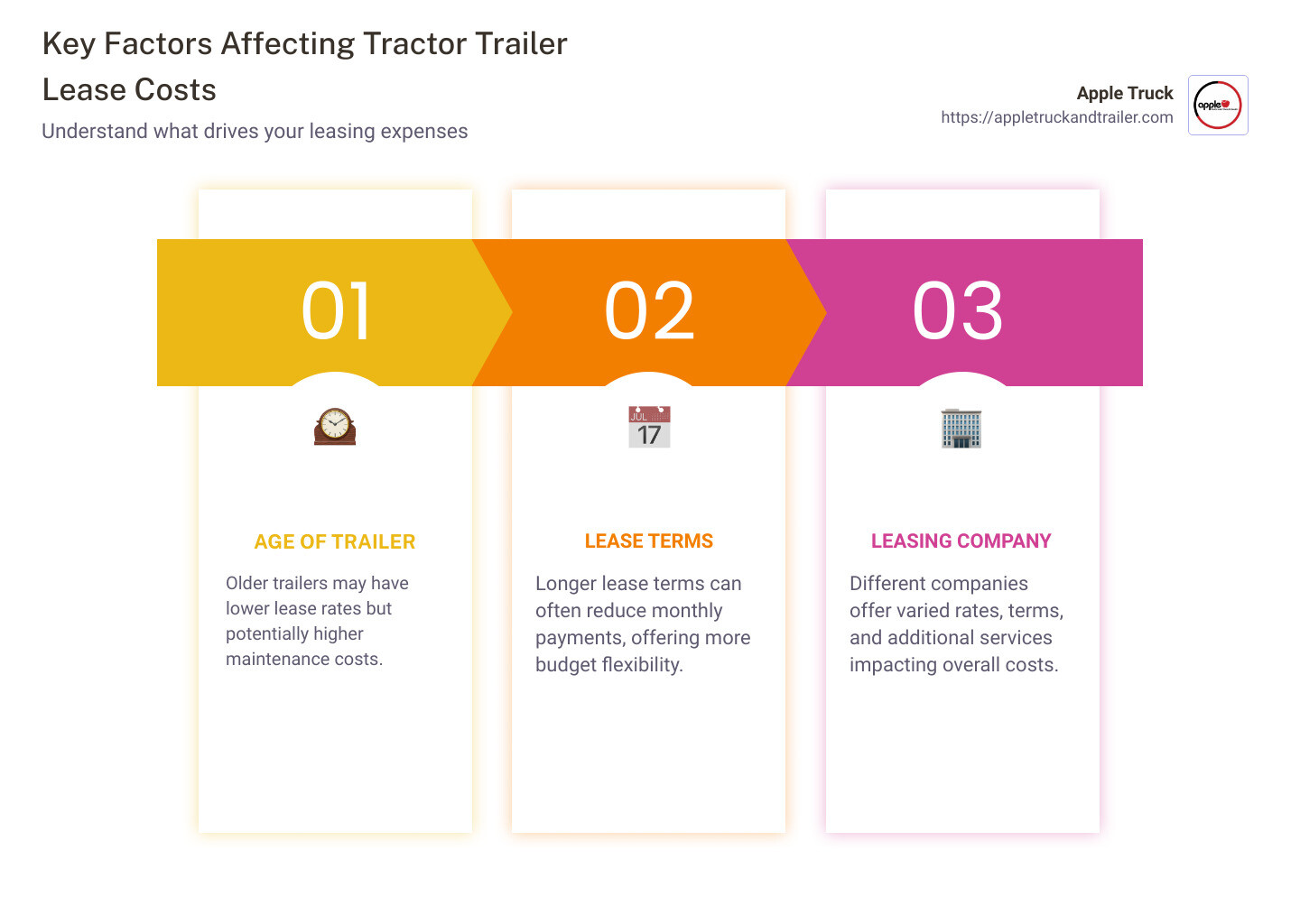

Factors Influencing Lease Costs

Several elements impact the cost of leasing a tractor trailer:

- Age of the Trailer: Generally, newer trailers cost more to lease than older ones due to their higher market value and newer technology. Additionally, an applicant’s credit score, including bad credit, can significantly influence the cost of leasing. While it is possible to obtain financing and leasing options for semi trucks with bad credit, it may result in higher interest rates and fees.

- Condition: Well-maintained trailers can command a higher lease price. The better the condition, the more reliable the trailer.

- Lease Term: The length of the lease agreement also affects the cost. Longer terms often result in lower monthly payments but might lead to higher total lease cost over time. Importantly, opting for a lease can offer lower upfront costs compared to purchasing, providing improved cash flow and predictable monthly expenses.

- Leasing Company: Different companies offer varying rates, so compare what different providers offer.

These factors combine to determine the monthly lease payment and overall cost effectiveness of leasing a tractor trailer.

Average Monthly Costs for New and Used Trailers

The monthly lease cost for tractor trailers varies significantly based on whether the trailer is new or used:

- New Trailers: Leasing a new trailer typically costs between $1,600 and $2,500 per month. These trailers come with the latest features and are less likely to require maintenance, which can be a significant advantage.

- Used Trailers: The cost to lease a used trailer can range from $800 to $1,600 per month, depending on the age and condition. While the lower cost is appealing, it’s important to consider potential maintenance and reliability concerns.

Understanding these costs helps businesses plan their finances more effectively and make informed decisions when choosing between leasing a new or used trailer. Each option has its benefits and challenges, and the right choice depends on the specific needs and budget of your business.

Remember that leasing provides businesses the flexibility to upgrade or change equipment as their needs evolve, without worrying about resale value or long-term maintenance costs.

Benefits of Leasing a Tractor Trailer

Leasing a tractor trailer offers several significant advantages that can help businesses manage their finances better and adapt more easily to changing market demands. Let’s explore how leasing can be a strategic choice for businesses looking to optimize their operations. One of the significant advantages of leasing a tractor trailer is the potential to save money on upfront and long-term costs, making it an attractive option for businesses aiming to maintain financial flexibility.

Predictable Monthly Expenses

One of the key benefits of leasing a tractor trailer is the predictability of monthly expenses. When you lease, you agree to a fixed monthly payment for the use of the trailer. This consistency allows for more accurate budgeting and financial planning. There are no surprises with sudden repair costs or maintenance fees, which often occur with owned trailers.

- Budgeting: Knowing your monthly lease payment helps you plan your financial resources better.

- Financial Planning: Regular and predictable payments aid in long-term financial strategies and forecasts.

No Ownership Hassles

Owning a tractor trailer can bring several challenges, including depreciation, maintenance, and the eventual need to sell the vehicle, which can be both time-consuming and financially draining.

- Depreciation: A leased tractor trailer does not affect your business assets as an owned vehicle would. You don’t have to worry about the loss in value over time.

- Maintenance: Generally, the leasing company handles maintenance issues, reducing your risk of unexpected repair costs.

- Resale: Exiting a lease is typically simpler than selling a used trailer. There’s no need to engage in the often lengthy and uncertain process of finding a buyer and negotiating a price.

By choosing to lease, you free up resources and managerial focus for core business activities, rather than the complexities of fleet management. This aspect is particularly beneficial for businesses that require up-to-date equipment to comply with industry regulations or to meet the operational demands efficiently.

In summary, leasing a tractor trailer can provide considerable financial flexibility and operational advantages. It allows businesses to access top-of-the-line models and avoid the pitfalls of depreciation and ongoing maintenance hassles. These benefits make leasing an attractive option for businesses looking to maintain a competitive edge with minimal financial strain.

How to Choose the Right Leasing Company

Choosing the right leasing company is crucial to ensure that you get the most value out of your tractor trailer lease, especially when it comes to commercial trucks. It’s important to select a leasing company that offers a variety of commercial trucks to meet different business needs, from semi trucks to other types of commercial vehicles. Here are key aspects to consider:

Reputation

Start by researching the reputation of the leasing company. Look for reviews and testimonials from other businesses that have leased trailers from them. A company with a positive reputation is likely to provide reliable service and fair terms.

Lease Terms

Understanding the lease terms is essential. Here are the key components to look for:

- Length of Lease: Determine if the lease duration aligns with your business needs.

- Payment Structure: Look for clear information on monthly payments and any upfront costs.

- Mileage and Usage Limits: Check for any restrictions that might affect your operational capacity.

Customer Service

Good customer service is vital. Ensure the leasing company offers comprehensive support, including a dedicated account manager who can address any issues promptly. Reliable customer service ensures smoother operations and less downtime.

Evaluating Lease Agreements

When evaluating lease agreements, pay careful attention to the following:

- Early Termination Fees: Understand the penalties if you decide to terminate the lease early.

- Maintenance and Repair Responsibilities: Know who is responsible for maintenance and repairs as this can significantly affect your operational costs.

- Insurance Requirements: Check what type of insurance is required and who bears the cost.

It’s important to read the fine print and understand all the terms and conditions to avoid hidden fees and unexpected charges.

Importance of Customer Support

Effective customer support can greatly influence your leasing experience. Here’s why it matters:

- Assistance: Quick help in case of breakdowns or accidents can prevent long downtimes.

- Reliability: Knowing that you can rely on your leasing company for support gives peace of mind.

- Trust: A trustworthy leasing partner is invaluable for long-term business relationships.

Choosing the right leasing company by focusing on reputation, lease terms, and customer service can lead to a beneficial partnership that supports your business’s needs and growth. This careful selection process ensures you can focus on your core business activities, rather than the complexities of fleet management.

Conclusion

At Apple Truck and Trailer, we take immense pride in our unwavering commitment to serving our clients. We understand that navigating the complexities of tractor trailer lease costs can be daunting. That’s why we are dedicated to providing transparent, straightforward leasing options coupled with exceptional customer service.

Our Commitment

We are committed to helping you find the perfect leasing solution that aligns with your business needs and budget. Whether you’re looking for the latest models or seeking a cost-effective lease for a used trailer, our team is here to guide you every step of the way. We ensure that all terms are clearly explained, with no hidden fees, providing a leasing experience you can trust and rely on.

Exceptional Customer Service

Our customer service doesn’t stop at the lease agreement. We provide ongoing support to ensure that your experience with your leased tractor trailer is as smooth and beneficial as possible. Our team is always ready to assist with any questions or concerns, helping you to keep your operations running efficiently without any unexpected hurdles.

Contact us today at Apple Truck and Trailer. You’re not just leasing a tractor trailer; you’re also gaining a partner who is invested in your success. We strive to foster long-term relationships with our clients, ensuring that you can count on us for all your truck and trailer needs.

Discover more about our truck and trailer leasing options and how we can support your business.

Thank you for considering Apple Truck and Trailer. We look forward to serving you and helping you navigate the road to success in the trucking industry.

Frequently Asked Questions about Semi Truck Leasing

Is Leasing a Tractor Trailer a Good Idea?

Leasing a tractor trailer can be a smart decision for many businesses, especially for those concerned about credit and down payments. Unlike purchasing, leasing often requires a smaller upfront investment, which can be easier to manage if cash flow is a concern. This lower initial cost allows businesses to preserve capital for other essential operations or investments.

For businesses with less-than-perfect credit, leasing can also provide an opportunity to access newer or more reliable equipment that might not be feasible if purchasing outright. Leasing companies often have different credit requirements than traditional loans, making it a viable option for those working to improve their financial standing.

What is the Average Semi-Truck Payment Per Month?

The average monthly payment for leasing a semi-truck can vary widely based on several factors such as the age of the truck, lease terms, and the financial health of the business. Typically, businesses can expect:

- New Trailers: Monthly lease payments can range from $1,600 to $2,500.

- Used Trailers: These can be significantly cheaper, with payments ranging from $800 to $1,600 per month.

It’s crucial to use a business loan calculator to estimate monthly payments accurately. This tool helps factor in the lease term, interest rates, and other financial obligations to provide a clearer picture of monthly expenses.

What Are the Benefits of Leasing a Semi-Truck?

Leasing a semi-truck offers several advantages that can be particularly appealing for businesses looking to maintain flexibility and manage costs:

- Lower Cost: Initially, leasing is generally less expensive than buying. This is due to lower upfront payments and, in many cases, lower monthly payments.

- Shorter Commitment: Leasing contracts can vary in length, often providing the option for shorter-term commitments. This is ideal for businesses experiencing rapid growth or those with changing needs.

- Upgrade Options: Technology and truck specifications can evolve quickly. Leasing offers the flexibility to upgrade to newer models at the end of a lease term, ensuring your fleet is always equipped with the latest technology.

These benefits highlight why leasing can be a strategic choice for businesses looking to optimize their operational efficiency and financial health. By understanding these key aspects, companies can make informed decisions that align with their long-term business goals and current financial situation.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, semi trailer trucks, semi truck leases and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.