Why Leasing a Box Truck is Smart for Your Business

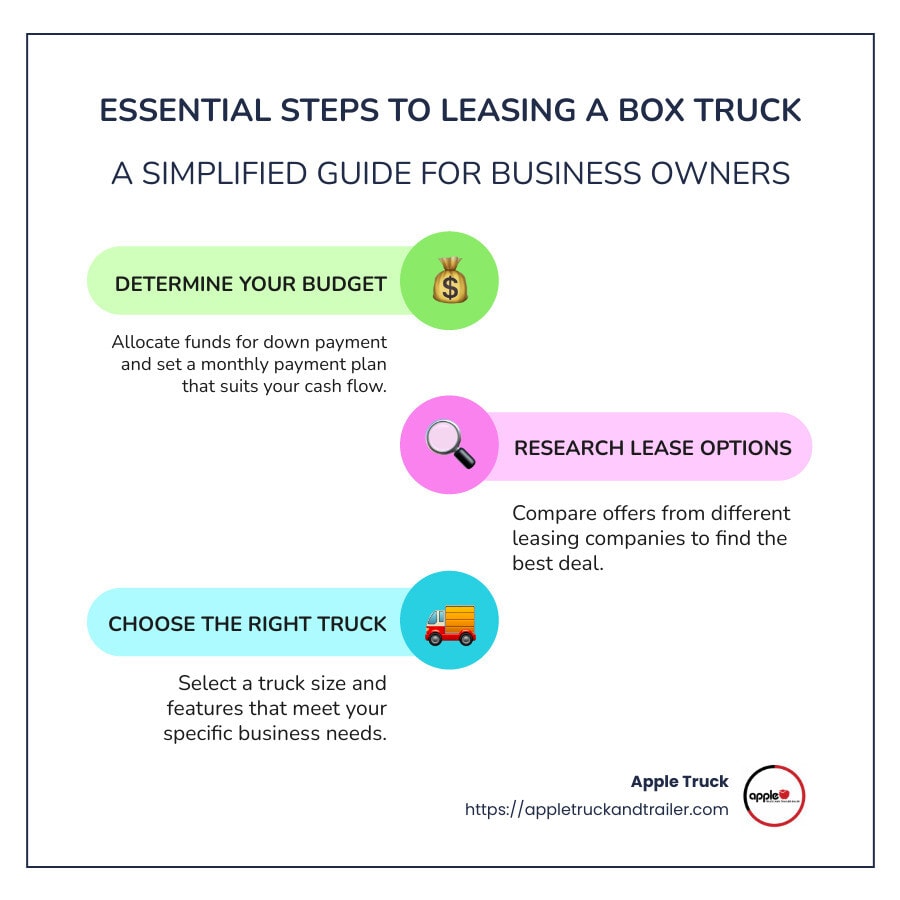

If you’re wondering how to lease a box truck, you’ve come to the right place. Here’s a quick breakdown to get you started:

- Determine Your Budget: Set aside funds for the down payment and monthly lease payments.

- Research Lease Options: Compare offers from different leasing companies.

- Choose the Right Truck: Select a truck size and features that meet your needs.

- Read the Fine Print: Understand all costs and restrictions in your lease agreement.

Leasing a box truck can be a game-changer for your business logistics. It offers improved cash flow, helps you avoid the hefty upfront costs of buying a truck, and provides access to newer, well-maintained vehicles. This means fewer breakdowns and more reliable service for your customers.

Additionally, TRAC leases come with additional benefits such as lower monthly payments, 100% tax deductibility, and favorable residual values.

I’m Michael Sensano, Sales Manager at Apple Truck and Trailer, with years of hands-on experience in truck leasing. I’ve helped countless businesses steer the complexities of leasing a box truck and I’m here to make it simple for you, too.

Table of Contents

Understanding Box Truck Leasing

Leasing a box truck can be a practical and cost-effective choice for your business. It allows you to use a truck without the significant upfront costs associated with purchasing one. Leasing options are available for various commercial vehicles, including box trucks and vans, which cater to different business needs.

Here’s a deeper dive into the types of leases and the benefits of leasing a box truck.

Types of Box Truck Leases

When it comes to leasing a box truck, there are three main types of leases to consider:

- Finance Lease (Lease to Own)

A finance lease, also known as a lease-to-own, allows you to own the truck at the end of the lease term, usually for a nominal fee like $1. This type of lease is ideal if you plan to keep the truck for a long time and want to eventually own it.

- Terms: Up to 72 months.

- Benefits: No mileage restrictions, ownership at the end of the lease.

- Fair Market Value Lease (FMV)

With an FMV lease, you return the truck at the end of the lease term and have the option to purchase it at its fair market value. This lease type typically has lower monthly payments and is fully tax-deductible as an operating expense.

- Terms: Flexible, often with lower monthly payments.

- Benefits: Lower initial costs, tax advantages.

- TRAC Lease (Terminal Rental Adjustment Clause)

A TRAC lease is a special type of FMV lease that pre-determines the residual value of the truck at the start of the lease. This means you know upfront how much you’ll pay if you choose to purchase the truck at the end of the lease.

- Terms: Flexible, with pre-determined residual values.

- Benefits: Predictable end-of-lease costs, potential tax benefits.

Benefits of Leasing a Box Truck

Leasing a box truck offers several advantages that can help your business run more smoothly and cost-effectively.

- Improved Cash Flow: Leasing a truck means lower monthly payments compared to buying one outright. This helps free up cash for other business expenses.

- Consistent Costs: Lease agreements often include maintenance services, which means fewer unexpected repair costs. This allows for more predictable budgeting.

- Maintenance Services: Many leases come with comprehensive maintenance packages. This ensures your truck stays in good working condition, reducing downtime and keeping your deliveries on schedule.

Leasing options also include refrigerated vehicles, which are essential for businesses needing temperature-controlled transportation.

Real-World Example

Imagine you run a small logistics company. You lease a 26-foot box truck with a finance lease. The predictable monthly payments and included maintenance services help you manage your budget better. Plus, at the end of the lease, you own the truck, adding value to your company’s assets.

Leasing a box truck can be a savvy business move. It provides flexibility, helps manage cash flow, and ensures you have a reliable vehicle to meet your logistics needs.

Next, we’ll dive into the steps to lease a box truck, starting with determining your budget.

How to Lease a Box Truck

Leasing a box truck can be a smart financial decision for your business. It allows you to use a truck without the hefty upfront costs. Here’s a step-by-step guide on how to lease a box truck:

It’s important to know the designated locations for returning the truck at the end of the lease period to ensure a streamlined and efficient drop-off process.

Determine Your Budget

First things first, figure out your budget. This includes:

- Down Payment: Many leases require a down payment, which is a one-time payment made at the beginning of the lease. The amount can vary, but typically, the larger your down payment, the lower your monthly payments will be.

- Monthly Payments: Calculate what you can afford to pay each month. Your credit score will impact these payments. The better your credit, the lower your monthly payments will be.

- Term of the Lease: Decide how long you want to lease the truck. Leases usually range from 24 to 60 months. A shorter lease will have higher monthly payments but allows you to upgrade sooner. A longer lease will have lower monthly payments but commits you to a longer term.

Shop Around for the Best Lease Offer

Once you have your budget, it’s time to find the best deal.

- Research: Look into different leasing companies and their offers. Compare the terms, interest rates, and any additional fees.

- Compare: Don’t settle for the first offer you get. Compare multiple offers to see which one fits your budget and needs best.

- Negotiate: Don’t be afraid to negotiate the terms of the lease. Whether it’s a lower interest rate or a reduced down payment, negotiating can save you money.

Choose the Right Box Truck

Finally, select the truck that suits your business needs.

- Size: Make sure the truck is the right size for your operations. A 26-foot box truck is a popular choice for many businesses because it offers ample space without being too cumbersome.

- Payload: Consider the types of loads you’ll be carrying. Ensure the truck can handle the weight and volume of your typical cargo.

- Features: Look for features that will make your job easier. This could include a lift gate, fuel efficiency, or advanced safety features.

Delivery trucks are a popular choice for businesses needing to expand their fleet or start with their first delivery truck.

By following these steps, you can lease a box truck that meets your business needs and fits within your budget. Next, we’ll break down the costs associated with leasing a box truck.

Costs Associated with Leasing a Box Truck

When leasing a box truck, understanding the associated costs is crucial. Here’s a breakdown of what you can expect:

Costs can vary depending on the type of truck, including straight trucks, which are commonly used in various commercial applications.

Monthly Lease Payments

Your monthly lease payments are influenced by several factors:

- Credit Score: A higher credit score can significantly lower your monthly payments. For instance, a credit score of 650 or above is generally considered good and can help you secure better terms. Borrowers with a history of making timely payments often receive more favorable rates.

- Lease Length: The term of your lease also affects your monthly payments. Leases typically range from 24 to 60 months. A shorter lease term will mean higher monthly payments but allows for quicker upgrades. Conversely, a longer lease term will lower the monthly payments but extend your financial commitment.

- Truck Size: The size and type of the box truck can impact the cost. A 26-foot box truck might have higher monthly payments compared to smaller trucks due to its larger size and greater payload capacity.

Additional Fees and Charges

In addition to your monthly payments, be aware of other fees and charges:

- Down Payment: This is a one-time payment made at the start of your lease. While it varies, a larger down payment typically reduces your monthly payments.

- Interest Rates: The interest rate on your lease can vary based on your credit score and the lender’s policies. A higher interest rate will increase your overall cost.

- Taxes: Taxes are usually added to your lease payments. Be sure to factor these into your budget.

- Insurance: Leasing companies often require you to carry insurance on the truck. The cost of insurance can vary based on the truck’s value, your driving history, and the coverage levels you choose.

- Maintenance Costs: Some leases include maintenance services, but if not, you’ll need to budget for regular upkeep. This can include oil changes, tire rotations, and other routine services to keep the truck in good condition.

By considering these factors, you can better plan for the total cost of leasing a box truck. This ensures you make a financially sound decision that benefits your business.

Next, we’ll discuss tips for negotiating a better lease deal.

Maintenance and Repair Responsibilities

When leasing a box truck, understanding your maintenance and repair responsibilities is crucial to ensure smooth operations and avoid unexpected costs. At COOP, we prioritize providing reliable and well-maintained fleet vehicles, but we also require our customers to take care of the vehicle during the lease period.

Tips for Negotiating a Better Lease Deal

Key Negotiation Strategies

- Down Payment: A larger down payment can reduce your monthly lease payments. Negotiate to see if the leasing company will accept a higher initial payment to lower your ongoing costs.

- Interest Rate: Your credit score plays a big role here. Check your credit report before negotiating. If your score is high, use it to your advantage to get a lower interest rate. If not, consider improving your score before applying.

- Lease Term: The length of your lease affects your payments. Negotiate for a term that balances your monthly payment with your long-term financial plans. A shorter lease means higher payments but faster upgrades, while a longer lease lowers payments but stretches your commitment.

- Mileage Limits: Some leases come with mileage restrictions. Negotiate these limits based on your business needs. If you expect to drive a lot, ensure the lease accommodates this without hefty penalties.

- Additional Fees: Ask for a detailed breakdown of all fees. Negotiate to waive or reduce any that seem excessive or unnecessary. This might include administrative fees, early termination fees, or excess wear and tear charges.

Understanding Lease Terms

- Fine Print: Always read the fine print. Understand every term and condition before signing. Look out for clausesthat might cost you later, like fees for exceeding mileage limits or penalties for early termination. Understanding industry-specific terms, such as those used in the trucking industry, is crucial for better navigating lease agreements.

- Hidden Fees: Some leases have hidden fees that aren’t immediately obvious. Ask direct questions about all possible charges. Ensure there are no surprises.

- Early Termination: Understand the consequences of ending the lease early. Negotiate for flexibility in case your business needs change. Some leases have harsh penalties for early termination, so knowing this upfront can save you trouble later.

- Maintenance Responsibilities: Know who is responsible for maintenance and repairs. Negotiate a maintenance package if it’s not included. This can save you from unexpected costs and keep your truck in good working condition.

- Residual Value: For TRAC leases, the residual value is crucial. Ensure it’s reasonable and reflects the truck’s expected condition at the end of the lease. A high residual value can lower your monthly payments but might cost you more if the truck depreciates faster than expected.

By using these strategies and understanding the lease terms, you can secure a better deal that fits your budget and business needs.

Conclusion

Leasing a box truck can be a smart move for your logistics business. It offers benefits like improved cash flow, consistent costs, and often includes maintenance services. However, understanding the different types of leases, associated costs, and negotiation strategies is crucial.

Summary:

- Types of Leases: Choose between finance leases, fair market value leases, and TRAC leases based on your business needs.

- Budgeting: Consider down payments, monthly payments, and the lease term.

- Shopping Around: Research and compare offers to find the best deal.

- Choosing the Right Truck: Ensure the truck’s size, payload, and features match your requirements.

- Costs: Be aware of monthly lease payments, interest rates, taxes, insurance, and maintenance costs.

- Negotiation: Use key strategies to negotiate better terms and understand the fine print to avoid hidden fees.

Final Tips:

- Check Your Credit Score: A higher credit score can get you better lease terms.

- Understand Lease Terms: Be clear on the length of the lease and any associated costs.

- Read the Fine Print: Hidden fees can add up. Make sure you know all the details before signing.

Contact us today at Apple Truck and Trailer to learn how we can help you lease the perfect box truck for your needs. We specialize in helping businesses like yours find the right leasing solutions. With our wide selection of high-quality trucks and commitment to exceptional customer service, we can guide you through the leasing process smoothly.

By following these guidelines, you can confidently lease a box truck that meets your business requirements and supports your growth.

Frequently Asked Questions about Leasing a Box Truck

What Credit Score is Needed to Lease a Box Truck?

Your credit score is a crucial factor in leasing a box truck. Generally, a credit score of 650 or above is considered good and can help you secure better lease terms. Leasing companies prefer borrowers with a history of making payments on time. If your credit score is lower, you might still get approved, but expect higher monthly payments and possibly a larger down payment.

Tip: Before applying, check your credit report for any errors and take steps to improve your score if needed. This can save you money in the long run.

How Long Should the Lease Term Be?

The lease term, or the length of time you’ll make payments, can vary. Common terms range from 24 to 60 months, with 36 months being typical.

Pros of a Shorter Lease (24-36 months):

- Higher monthly payments but the ability to upgrade to a new truck sooner.

- Less commitment if your business needs change.

Cons of a Shorter Lease:

- Higher monthly costs.

- More frequent negotiating of new leases.

Pros of a Longer Lease (48-60 months):

- Lower monthly payments, making it easier on your cash flow.

- Longer use of the same truck, which can be good if you prefer stability.

Cons of a Longer Lease:

- Longer commitment period.

- Potential for higher maintenance costs as the truck ages.

Are There Any Hidden Fees in a Box Truck Lease?

Yes, there can be hidden fees in a box truck lease. It’s essential to ask direct questions and read the fine print to avoid surprises.

Common Hidden Fees:

- Taxes: These can add up, so know your local tax rates.

- Insurance: Often required by the leasing company.

- Maintenance Costs: Who is responsible for regular maintenance and repairs?

- Mileage Fees: Exceeding the agreed mileage can result in hefty penalties.

- Early Termination Fees: If your business situation changes and you need to end the lease early, you might face high penalties.

Tip: Always request a detailed breakdown of all potential fees before signing the lease. This transparency helps you budget better and avoid unexpected costs.

By understanding these aspects, you can make a more informed decision when leasing a box truck. This knowledge will help you avoid common pitfalls and ensure the lease terms align with your business needs.

OUR CONTENT

All the information you find on our website is thoroughly researched and verified by our team of truck and trailer specialists, who bring over 40 years of experience to Auburn, Massachusetts, and the surrounding areas, and Boston. At Apple Truck and Trailer, we’re all about great service and quality trailers. Ours aren’t just trailers; they’re custom solutions for your transport needs. We understand how important reliability is for your business, and we’re here to help every step. Check out our Landoll trailers, long haul transport, semi trailer trucks, semi trucks and secure storage containers for an upgrade with expert support. We’re dedicated to providing content that’s not only accurate but also meaningful and useful for our readers.